An associate may have multiple CommBank Digi Lenders, in addition to mutual programs, nevertheless they will simply qualify for Qantas Issues immediately after. Get conditional pre-recognition to with confidence discover your residence. Talk to one of the loan providers or start your application online inside ten minutes. Financing, has, and you will gift ideas is 3 ways so you can enhance your own deals to have a down payment. Utilize this research tool discover and apply to have financial help. Uncover what you’d owe per month considering a specific purchase rate, rate of interest, length of your loan, and the size of their downpayment.

The rate and you will amount of a loan largely regulate how far your typical payments would be. The bank otherwise financial might want to see which you can meet your instalments, then particular. Lenders might think about if or not you have got one present debts, while you are having fun with a great guarantor for your house financing, and the rate of interest to the financial equipment you’re applying to. Mortgage brokers commonly authorised by Currency Australian Borrowing License and you may operate lower than their Australian Borrowing Licence, otherwise while the a card member of some other Australian Credit Licensee. Home loans makes information regarding the mortgage items that can get match your expectations, finances and requires.

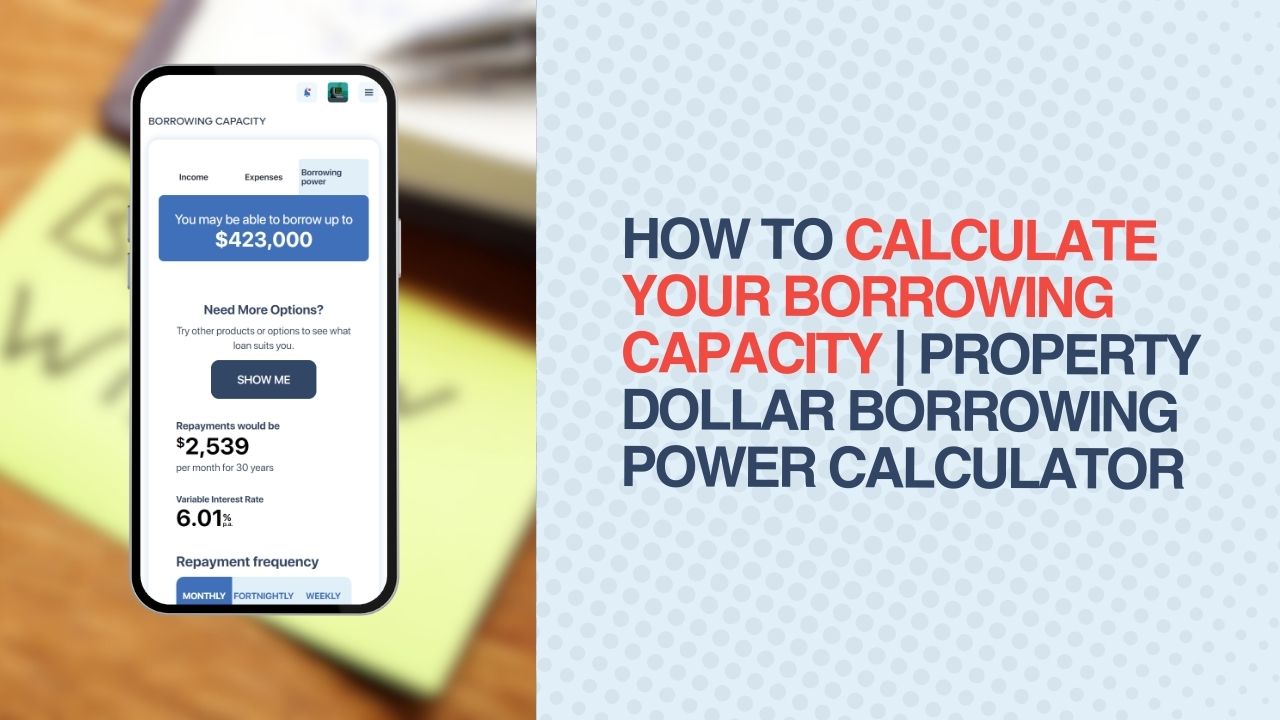

What’s the mortgage installment calculator?

They implies that your own repaired houses will cost you (home loan repayments, insurance policies, rates) is always to essentially become just about 28% of your income prior to income tax. For those who add in your own other most recent personal debt payments (financing, handmade cards, store credit) it ought to be just about 36% of the income ahead of taxation. Keep in mind that the attention rates on the calculator try at the mercy of alter, that may affect cost numbers. If the a variable rates loan is chosen, the pace might possibly be at the mercy of change from the identity of one’s financing. For a predetermined rate loan, while the fixed rate several months ends, the mortgage reverts in order to a varying rate financing and you may installment number get alter. The newest payment calculator doesn’t tend to be all the rates of interest, fees and you will costs.

Normally, a higher debtor electricity means that you could qualify for an excellent large amount borrowed, that can open up much more options for to find a house. Based on CBA, a great rule of thumb is that the home loan repayments shouldn’t exceed 31% of the net income, making certain you may have enough independence for other costs and you will offers. If you want to interest much more about quoting monthly repayments, the house loan money calculator can help leave you a clearer picture of possible will cost you. Inside The fresh Zealand, it’s standard practice to own a lender or property financing team to give around 80% of the worth of the house or property we want to purchase.

Rating a financial agent to your benefit.

And that’s not to mention that you generally need to use out lenders mortgage insurance rates (LMI) with in initial deposit out of less than 20% of your purchase price – and therefore just contributes to your costs. Most lenders will also take a look at your own borrowing electricity in accordance with the financing identity (the size of the loan) and also the type of mortgage you need.

You could potentially fundamentally improve your borrowing electricity by considering the issues you to definitely dictate they and working in these personally. Although some of them alter might not create a direct distinction, the new impact on your own borrowing from the bank power will get prove higher than the fresh amount of their parts over time. Most people start by deciding what they can afford since the an excellent payment per month. A common first step is to calculate twenty-five% of your own gross month-to-month money to assist dictate a manageable month-to-month mortgage repayment.

How to do a credit score sign in Australian continent

The house mortgage hand calculators and you may products try right here in order to of your house loan believed. You will discover how much you might borrow, estimate your payments and then make exactly how much you actually need to possess a deposit. You use the fresh “Just how much should i obtain?” unit just after providing including information, and it also efficiency having a quote of between £2 hundred,000 and you will £250,100000, based on your credit report and you will present debts.

You can talk with their movie director on the a cover rise, increase your instances if you’re region-day, look for a new and higher-using employment, otherwise consider a supplementary money stream. You can even pay attention to it referred to as ‘borrowing skill’, but both conditions are interchangeable. When it’s a good investment otherwise a new home, you’re questioning just how much you’ll manage to invest as the an initial-house consumer – put simply, the borrowing strength. Up the money you were previously putting towards those debts and increase your borrowing electricity. Interest prices are affected by the newest financial areas and will change daily – or many times inside the same day. The changes are based on many different monetary symptoms in the financial places.

A strong DTI can also be change your mortgage alternatives, probably minimizing interest levels and you can expanding approval possibility. As the harmony of your financing boils down, therefore do the eye energized when. Because your mortgage repayments is remaining an identical each month (given the interest rate hasn’t changed), the principal your’re also repaying gradually develops anytime.

Costs tend to be people unique provide write off available on qualified finance (offers and you can qualification criteria at the mercy of changes). Qualifications standards apply to special make discounts available for ANZ Ease And home loans, along with $fifty,100000 or maybe more inside the the new otherwise additional financing. The fresh guess will be some other in the event the fee type of is actually desire simply or if perhaps a new interest discount applies. To try to get a keen ANZ Home loan you should complete an application.

Your information

For those who’re also not comfortable with almost a third of your own income supposed on the your home loan, you’ll would not like looking at the top of your budget. The initial issue is, “How much house can i manage? ” That’s as the even with all anxiety doing work in trying to get being recognized to own a home loan, lenders usually are lured to mortgage you more cash than simply you predict. Lenders should assess the ability to make month-to-month mortgage payments, as well as your earnings will likely be an important technique for upkeep these. If you’re not in a position to accessibility a mortgage as you do not have the put, however are able to afford the mortgage costs, in initial deposit Boost Mortgage would be of use.